Connect with us

Slack vs Zoom : Who is Losing the Momentum?

Since the nationwide lockdowns in wake of COVID-19, there haven't been too many stocks that have been spared from the share market massacre.

Since February, the broader markets have lost more than a quarter of their value. But for virtual collaboration tools like Zoom and Slack, the scenario is completely opposite.

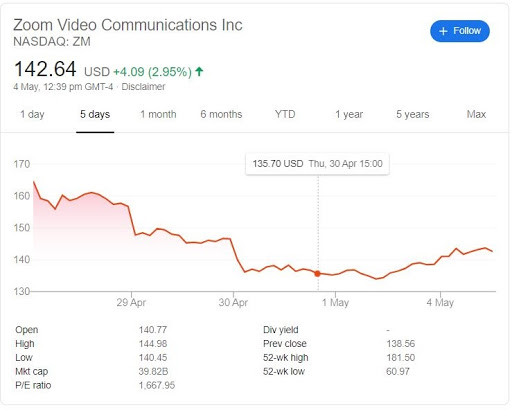

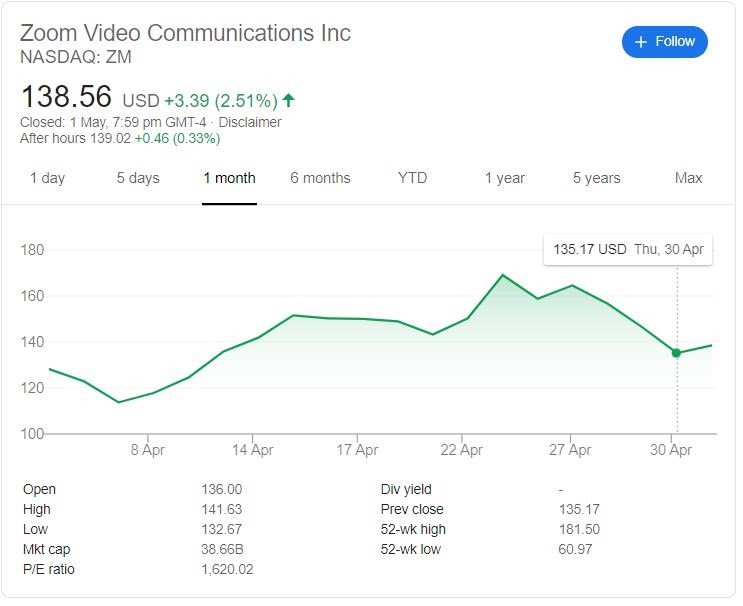

Zoom’s download has skyrocketed. Just take a look at the Zoom stock chart and see how COVID-19 changed the game for Zoom video Stock:

Zoom video stock has a strong RS line now. But considering the last few days, there has been a significant loss in momentum:

So, what happened? Why did Zoom lose momentum? Why did Zoom Stock fall?

For the answer, we turn to the pages of today's The Washington Post, which reports "some school districts around the country have started to ban the use of Zoom for online learning from home." These bans come in response to an FBI warning about the phenomenon of "Zoom-bombing" -- malefactors hijacking Zoom teleconferences and inserting themselves into the meetings.

Now, this doesn’t mean Zoom is out of the game. Zoom Video stock is trading at a staggering 1,300 times trailing earnings -which suggests that the shares were priced for perfection and are forecast to generate a higher Return on Assets (6.98%).

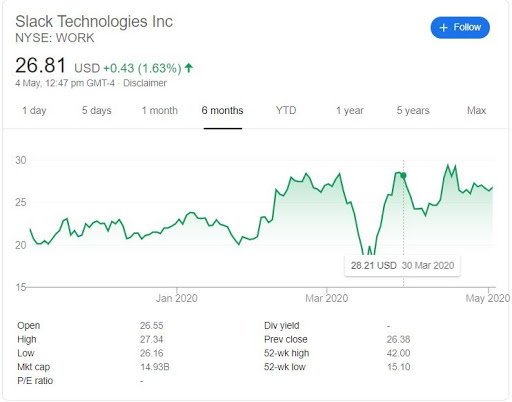

Much like Zoom, Slack also benefited from coronavirus lockdowns. Investors started to realize its full potential as a revolutionary product and this happened:

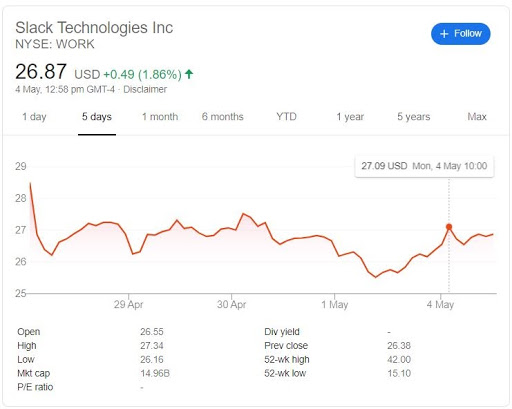

But, unfortunately, it is not all sunshine and rainbows at Slack either. There is a massive elephant in the room - Microsoft Teams. Apart from the competition with Microsoft, Slack’s lack of growth still remains a principal concern among investors. And, eventually, Slack too lost the momentum:

Now, if these ups and downs in the Slack stock chart and Zoom stock chart confuse you, and you can’t decide between either of these, this article can help.

Slack vs Zoom

In this article, I’ll share everything you need to know about buying zoom stock or slack stock - starting from the key differences between these tools, current market changes in wake of COVID-19, the overall growth and profitability, and much more.

By the end of the article, you’ll be able to make a more informed decision about slack and zoom stock.

Let’s start with an overview of both these tools:

Slack and Zoom: Key Background

Slack as a business communication and collaboration tool

Slack as a pioneer communication platform connects teams with communication and collaboration features. Founded in 2013, Slack became one of the fastest-growing SaaS startups in just five short years.

The Slack free plan offers basic features and paid plan offers more perks like unlimited app integration, guest accounts, unlimited message archive, and a dedicated customer support team.

Slack paid plan starts: at $6.67 per user per month when billed annually. For larger companies, Slack offers an enterprise plan that costs $12.5 per user per month.

Zoom as a Video and Web Conferencing Tool

Zoom is the leader in modern enterprise video communications, with an easy, reliable cloud platform for video and audio conferencing, chat, and webinars.

Zoom has evolved from an already-successful IPO to a stock market juggernaut worth more than Uber and Lyft combined. Its mobile app has skyrocketed by 728% since March 2, 2020.

Zoom is designed for larger group meetings. Its free tier allows users to host meetings for 40-minutes. The participant limit in the free plan is 100 people.

Zoom’s paid plan costs: $14.99 to $19.99 per host per month. Paid users gain access to more cloud storage and larger group meetings and many more interesting features like auto-transcription and virtual backgrounds.

How COVID-19 has Impacted Zoom & Slack’s Growth

With the COVID-19 pandemic and the nationwide lockdowns, millions of workers have no option but to work from home.

And Suddenly, it’s time for remote collaboration tools like Zoom ZM, +2.51%, and Slack WORK, -1.16% to shine.

Amidst the bloodbath in the stock market, business collaboration and communication tools are on a roll — Both Slack stock and Zoom video communications stock have actually been rising.

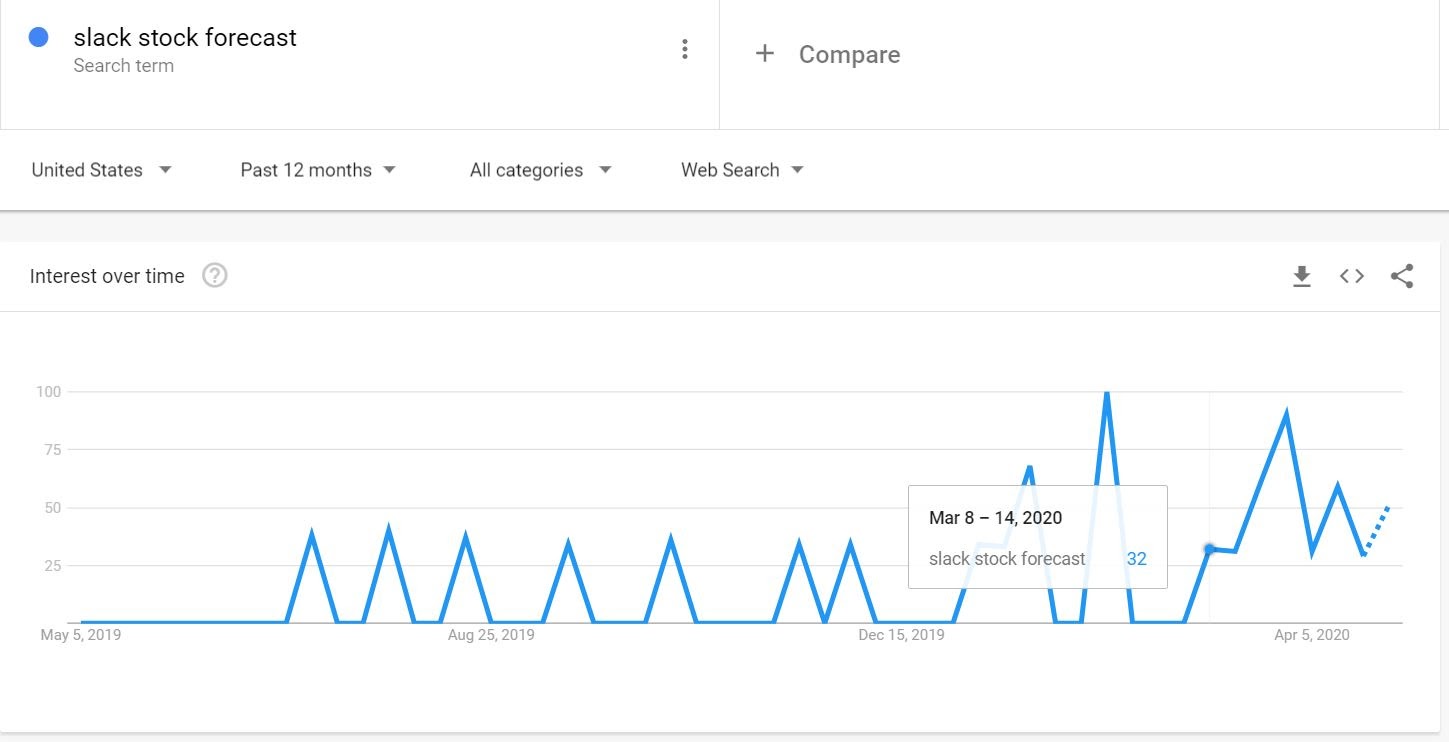

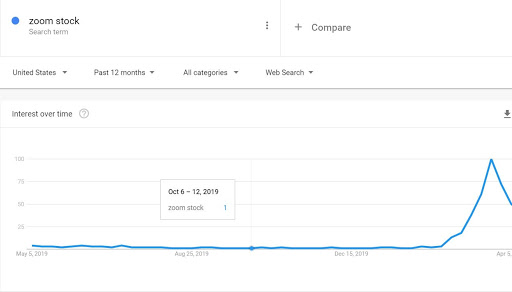

There’s a sudden increase in Google searches for Slack stock and Zoom Stock.

Take a look:

Since the pandemic lockdowns, the query for slack stock forecast has been on a consistent rise:

And the results are even more fascinating for Zoom. Take a look at Google Trend result for Zoom Video Communications Stock:

In all, both Slack Technologies and Zoom Video Communications are weathering the COVID-19 pandemic better than any other business in the market.

Since 2020, Slack's stock has increased by roughly 25% And for Zoom, the numbers are jaw-dropping. Zoom Stock has surged more than 120%.

Simply put, Slack and Zoom are gaining significant benefits because of the worldwide stay-at-home guidelines issued by the government. All employers and workers now rely on virtual collaboration tools - which explains why these tools are gaining momentum with mainstream and enterprise users.

Let's review Let’s take a look at both Slack’s and Zoom’s growth:

Slack Gained Momentum amid COVID-19

Slack’s growth rate, as shared in its quarterly report, looks solid. Here’s what Slack’s Chief financial officer said after its post-earnings plunge:

“We finished the year with 110,000 paid customers and 893 customers spending more than $100,000 annually with Slack,” said Allen Shim, Chief Financial Officer at Slack. While we invest in innovation and delivering more value to our customers, we also are showing significant leverage and remain on track to hit our growth phase target of free cash flow positive.”

Slack quarterly reports.

Slack’s Fourth Quarter & Fiscal Year 2020 Highlights:

- Total revenue was $181.9 million, an increase of 49% year-over-year.

- Calculated Billings were $254.7 million, an increase of 47% year-over-year.

- Total revenue was $630.4 million, an increase of 57% year-over-year.

- Calculated Billings were $765.3 million, an increase of 48% year-over-year.

- Over 110,000 Paid Customers, up 25% year-over-year.

- Over 32,000 Paid Customers using shared channels, up from over 26,000 at the end of last quarter.

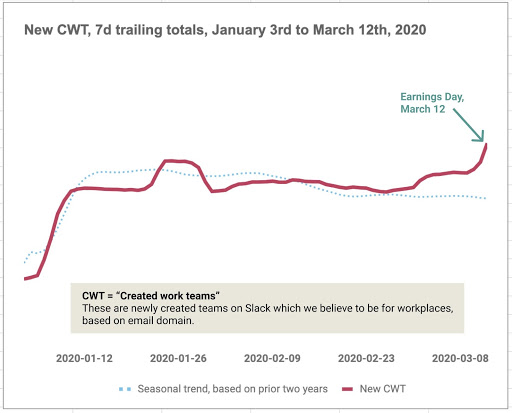

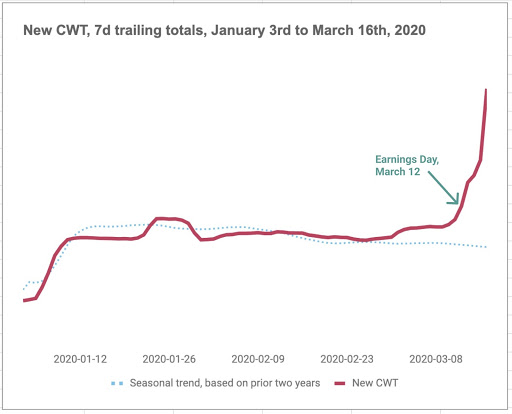

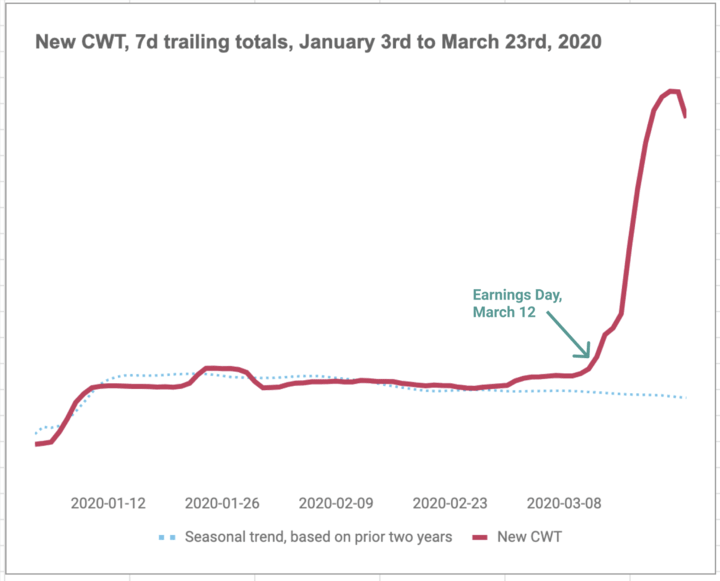

Slack’s CEO Steward Butterfield shared his delight about the sudden increase in Slack’s usage. He shared these pictures on Twitter. We could see in these charts the newly created Slack teams.

The first chart is from March 12th, the second is from March 16th, and the third IS from March 23rd.

Take a look,

Overall, Slack is winning not just against the status quo but also against its competitors.

Zoom’s growth amid COVID-19

Slack sure has witnessed a spike in sales and usage. But Zoom generated more traffic, downloads, and sales than Slack in the last few months.

Unlike Slack, Zoom didn’t disclose its exact number of paid users last quarter. But Zoom announced that its total number of users rose to 86% with over $100,000 in annual revenue. Zoom also stated that the number of customers grew 61% to 81,900.

According to Apptopic, Zoom saw about 600,000 new downloads last Sunday - which is the highest ever download in a single day.

“Zoom sits atop Apple’s rankings of the most popular free apps in dozens of countries, according to data from analytics company App Annie. Investors love it, at least for the moment. The Zoom Technologies stock sells for 58 times revenue, compared to a price-to-sales ratio of 8 for Microsoft, and it’s gained 26% since Feb. 19, while the S&P 500 has plunged 32% over that stretch.”

Jordan Nover, CNBC

Zoom Usage Highlights:

- During the Covid-19 pandemic, Zoom witnessed an increase of 67% between Jan and mid-March 2020 (Apptopia)

- During the Covid-19 outbreak, Zoom was used by 90,000 schools in 20 countries to teach remotely (Zoom)

- March 30, 2020, saw 4.84 daily mobile US users (a 151% increase year-on-year) (Apptopia via Reuters)

- Over the 2020 financial year (2019), 641 Zoom business customers were worth $100,000 or more, up to 86% (Apptopia)

- Zoom expects a revenue rise of 63% to 65% in the next quarter, which clearly beats their expectations for 53% growth.

Who is Growing Faster: Zoom Stock vs Slack Stock

It’s clear both Zoom and Slack are having a gala time. But as the trends show, Zoom is way ahead when compared with Slack’s growth.

Take a look:

Revenue Growth of Zoom and Slack:

Revenue Growth (YOY) | Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 |

Slack Technologies | 47% | 52% | 47% | 49% |

Zoom Video | 103% | 96% | 85% | 78% |

Source: Slack and Zoom Quarterly Reports

It’s clear. Zoom is leading - leaving behind many of its competitors.

Let’s have a few more statistical insights into Zoom’s growth over the last few months.

Which one is more profitable: Zoom Stock vs. Slack Stock?

As the table depicts, Zoom is trading like a cult stock. So If you’re weighing options between Zoom technologies stock and slack stock, you’ve to see these statistics:

Zoom daily downloads:

January 2020 | 56,000 |

February 2020 | 1.7 million |

March 2020 | 2.13 million |

(Source: Apptopia via The Guardian and The Economic Times)

Zoom Revenue as of FY 2019:

Q1 2019 | $121.5 million |

Q2 2019 | $60.1 million |

Q3 2019 | $74.5 million |

Q4 2019 | $90.1 million |

FY 2019 | $105.8 million |

(Sources: Zoom and AlphaStreet)

Zoom Revenue Forecast

Q1 2020 | $122 million |

Q2 2020 | $145.8 million |

Q3 2020 | $166.6 million |

Q4 2020 | $188.3 million |

FY 2020 | $622 million |

(Sources: Zoom and AlphaStreet)

Zoom Market Cap and Valuation:

1 July 2019 | $23.6 billion |

1 October 2019 | $20.7 billion |

3 January 2020 | $16.1 billion |

30 March 2020 | $40.5 billion |

(Source: Macrotrends)

Zoom Technologies Stock Price:

1 July 2019 | $86.86 |

1 October 2019 | $75.81 |

3 January 2020 | $68.72 |

30 March 2020 | $146.12 |

(Source: Macrotrends and TechCrunch)

Keeping these numbers in mind, one can see how Zoom’s net profit and usage have surged over the months. On a non-GAAP basis, Zoom’s net revenue increased more than six times to $101.3 million. Zoom is also expecting its non-GAAP EPS to rise 20%-29% in 2021 and it trades at 42 times its revenue forecast.

Who’s Losing the Momentum? Slack Stock or Zoom Stock

When you look at Slack in context to Zoom’s growth, Slack definitely seems to be losing its grip. If you’re considering buying slack’s stock, you have to know it’s not as profitable.

We are saying that considering the cost of hosting, expanding, and promoting its servers continually offset its revenue from the paid customers.

As you can see from its quarterly report, its net loss increased from $140.7 million in 2019 to $571.1 million in 2020.

On the non-GAAP basis that excludes its one-time expenses and the stock-based compensation, Slack’s total loss narrowed very slightly from $115.8 million to $113.4 million.

In simple terms, Slack expects to remain an unprofitable business despite the COVID-19 pandemic.

When you compare Slack stock price with Zoom stock price, you can see Slack trades at 16 times the total revenue estimate for 2021. On the contrary, Zoom is trading at 42 times the revenue forecast.

Slack’s Stock Forecast

Slack is subject to the forces wreaking havoc across the economy. Slack’s Stock has tumbled 20% in extended trading. In the current quarter, revenue will be $185 million to $188 million. The Analysts projected $188.4 million. Excluding some items, the loss will be 6 cents to 7 cents a share. Analysts, on average, estimated 8 cents, according to data compiled by Bloomberg.

Want to Buy Slack Stock or Zoom Stock: Consider These Points First

Sure, both Slack and Zoom’s growth has surged amid the Coronavirus pandemic. Even before the lockdowns, these tools were taking the market by storm.

But there’s another side of the coin that you’ve to consider before buying zoom or slack stock.

So far you know who’s growing by what margin and which stock may be profitable. Now, let’s have a quick overview of why you should think twice before buying any of these stocks:

Things to Consider when buying Slack’s Stock:

- Slack is fending competition with bigger rivals like Microsoft Teams -which witnessed even her surge in usage rates throughout the COVID-10 Pandemic.

- Slack’s net loss widened from $140.7 million in 2019 to $571.1 million in 2020.

- Slack's net loss only narrowed slightly from $115.8 million to $113.4 million.

- Analysts projected a loss of 6 cents to 7 cents a share, and Slack reported an adjusted loss of 4 cents a share

Things to Consider when buying Zoom’s Stock:

- A series of Zoom security blunders in the last two months sparked questions about its ability to help the security-conscious organization - which caused several customers to ban the app and go against its rivals.

- A report claimed that over 500,000 Zoom accounts have been hacked and are being sold on the dark web.

- In short, Zoom is still vulnerable to hacking attempts.

Verdict: Wait for a Deeper Pullback Before Buying Zoom Stocks

There’s no doubt that the COVID-19 crisis has lit a fire under team collaboration and communication tools like Zoom and Slack, but Slack still is far away from narrowing its losses. It’s also trying to fend off the competition with Microsoft and other Slack alternatives in the market.

On the other hand, Zoom is trading like a cult stock. If you’re considering making an investment in either of these tools, Zoom may sound like a safe choice but Zoom’s vulnerability to hacking attempts has become a growing pain. It has caused so many businesses to ban the platform.

Zoom needs to resolve its security issues before the hackers permanently trash its accountability and reputation. If Zoom can address such issues, it is definitely a better buy than Slack.

But If you were to make a decision now, the best would be to wait for a deeper pullback before getting any shares.